Due Diligence Audit Services

Due diligence Audit

Due diligence is an investigation or examination of a business entity prior to signing a contract or an act which require a certain standard of care. The investigation about the business entity’s financial, legal and other statutory compliances could be carried out for potential objectives for investment, merger, acquisition etc by a buyer.

While conducting a business, the management should take special care not to make any mistakes. These mistakes, however small, can lead to big problems and even bigger penalties down the line.

In the English language, Diligence means careful/persistent work/effort. Company Due Diligence refers to the examination and analysis of the company records, which will help in determining the financial standards of the company. This service is mostly availed by businesses when merging or acquiring new businesses.

These services will allow the management to gain the need of the present financial condition of the company and also help in uncovering any problems in the businesses. The management will be able to act on the said information and correct the course of the business.

The primary aim of Company Due Diligence is to check the value of all the assets and liabilities of the business. Due Diligence will also assess business risks that are currently being faced by the business or the potential threats which can occur in the near future.

The objectives of Company Due Diligence are:- Collect as much information about the target company as possible

- Conduct the SWOT analysis of the company to identify its strengths and weaknesses

- Identify the areas in which work is required.

- Help in the decision-making process for the management

- Enhancing the confidence of the investors and allows them to make informed decisions about investing in the company.

There are many other reasons due to which a company may conduct Due Diligence of the company. These reasons depend on the need and requirement of the company and also if fulfilling such requirement will pose a problem to the management or not.

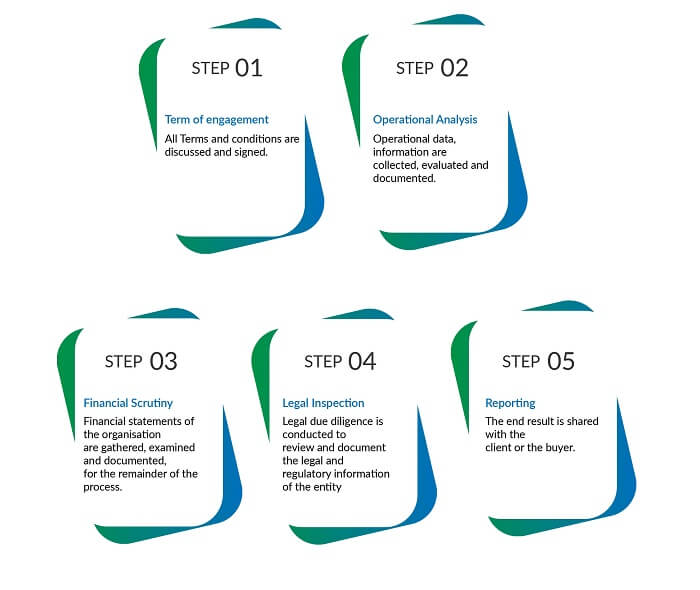

Company Due Diligence can be a lengthy process, and the different types of Due Diligence that management can choose from are:

1. Financial Due Diligence

Financial due diligence is a review of historical data, including trade results, cash flow and balance sheet of a company to know its financial position. It also includes a review of forecast performance and funding requirements.

2. Commercial Due Diligence

Commercial due diligence is conducted to examine various commercial factors, including market conditions, competitor analysis, product or service assessment, and any other commercial data the user wishes to investigate.

3. Operational Due Diligence

Operational due diligence considers the review of non-financial matters of a business, which may include insurance and risk assessment, HR activities, review of systems and processes, evaluation of management team.

4. Legal Due Diligence

Legal due diligence includes the investigation of any legal risk associated with the rights and obligation of the target company. The issues may involve intellectual property, employment disputes, and property ownership.

The management of a company must take special care to understand the requirements of the company and avail services according to the need and demand of the business.

The first and foremost advantage of Due Diligence is that it provides detailed information to the management about the business. This will help the management to make informed decisions relating to Mergers and Acquisitions. Due Diligence can also help the investors of a company by providing them with information about the various facets of the company. After getting this information, the investors can decide how these will affect the business in the long run and will be able to make an informed decision.

The final goal of Due Diligence is to discover new and important information about the business, which will help the management in taking decisions for the future of the business and increases the efficiency and profitability of the business.

-

-

- A due diligence report acts as a risk assessment tool for an organization

- It helps to discover any hidden information about the company

- It improves a company’s reputation

-

Due Diligence should be initiated by the management before making any decisions about a company. After having the complete information, the management will be in a better position to take decisions. The complete process of Due Diligence should be done in about 60 days or two months. However, the type of Due Diligence which has to be used by a business depends upon the management and the nature of the business conducted.

GSPU is a financial consultancy firm, offering a wide range of services including accounting, auditing, software consultancy, and management. We have been providing the best audit services in GCC,INDIA and other Asian and Middle East Countries. At GSPU we assist our clients to perform all type of due diligence in order to maximize the value from a proposed transaction.

In Due Diligence Services We provide the following due diligence services to our clients:

- Recognizing and quantifying deal-specific risks of the entity

- Helping to identify hidden costs, contingencies, and commitments of the company

- Finding the issues which are likely to affect the purchase price or contract conditions